Кредитна картка "Золота"

Кредитний ліміт

до 1 000 000 грн.

до 1 000 000 грн.

Пільговий період

до 67 днів

до 67 днів

Базова процентна

ставка 3.2% в міс.

ставка 3.2% в міс.

Основні умови картки

Безкоштовно

Відкриття рахунку

Відкриття рахунку

Безкоштовно

Обслуговування картки

Обслуговування картки

Visa

Тип картки

Тип картки

Цифрова/Фізична

Вид картки

Вид картки

UAH

Валюта картки

Валюта картки

5 років

Строк дії картки

Строк дії картки

Інформування

безкоштовно

безкоштовно

Поповнення

безкоштовно

безкоштовно

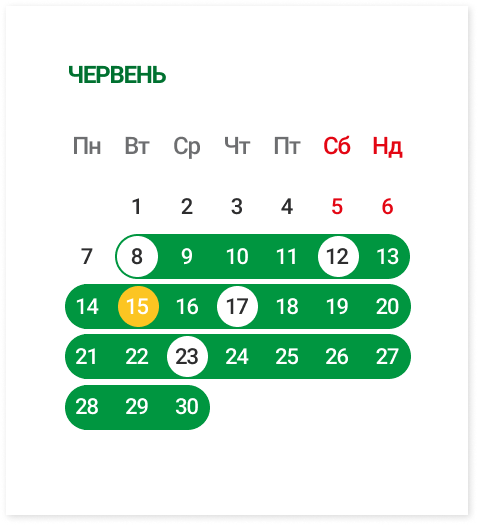

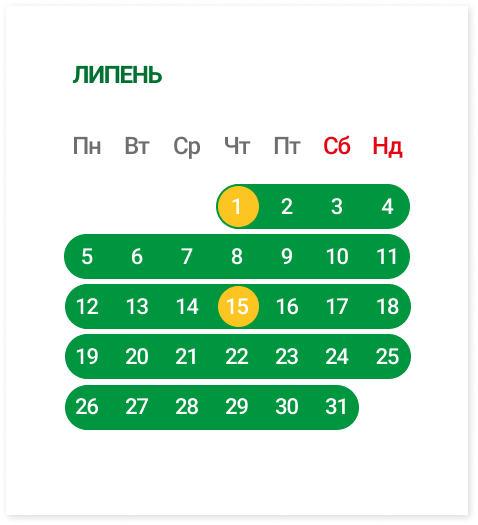

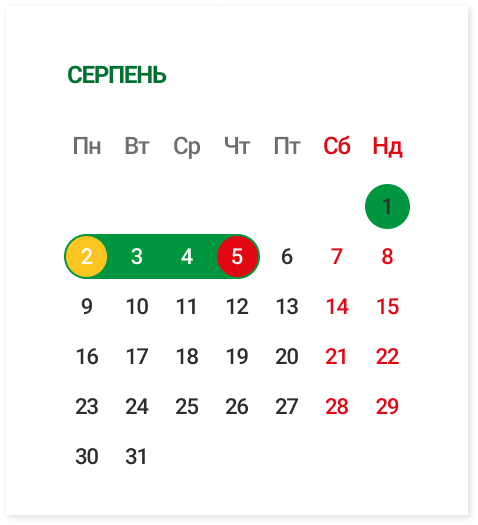

Пільговий період до 67 днів

Дати покупок.

Дати покупок.

Тривалість пільгового періоду - період, під час якого не нараховуються відсотки за користування кредитними коштами.

Тривалість пільгового періоду - період, під час якого не нараховуються відсотки за користування кредитними коштами.

Дата заробітної плати/авансу - імовірне/планове отримання зарплатних або авансових виплат.

Дата заробітної плати/авансу - імовірне/планове отримання зарплатних або авансових виплат.

Платіжна дата - день, до якого потрібно повернути суму кредиту станом на останній день позаминулого місяця, щоб користування кредитом було без переплат.

Платіжна дата - день, до якого потрібно повернути суму кредиту станом на останній день позаминулого місяця, щоб користування кредитом було без переплат.

Корисна інформація

| Сума кредитного ліміту | 0 - 1 000 000 грн |

| Процентна ставка на пільговий період (% річних) | 0,01% |

| Базова процентна ставка (% в місяць), нараховується на суму строкової заборгованості за кредитом | 3,2% в міс. |

| Реальна річна процентна ставка (% в рік) | 47,6% |

| Пільговий період | до 67 днів |

| Строк кредиту | 60 місяців, при цьому строк користування кредитом продовжується на кожні наступні 60 місяців, якщо щонайменше як за 30 календарних днів до дати повернення кредиту Банк не повідомить Клієнта про припинення кредитування. |

| Комісія за надання кредиту | відсутня |

| Комісія за обслуговування кредиту | відсутня |

| Комісії за обслуговування поточного рахунку з використанням платіжної картки | відсутня |

| Необхідність застави або поручителів | відсутня |

| Вік позичальника для отримання кредиту (на момент звернення за Кредитом) | від 20 року до 69 років |

| Проценти за порушення грошового зобов'язання (% річних) | 56% від простроченої заборгованості за кредитом за кожен день прострочення |

| Розмір мінімального щомісячного обов'язкового платежу | 2% від суми заборгованості або 100% суми заборгованості у випадку, якщо заборгованість менша або дорівнює 100,00 грн, та нараховані відповідно до умов договору проценти і комісії |

| Періодичність погашення мінімального щомісячного обов'язкового платежу | перший платіж - з 06 числа місяця, наступного за місяцем, в якому був використаний кредит, по 05 число місяця, що йде через один місяць після місяця, в якому був використаний кредит другий та кожний наступний платіж - щомісячно до 05 числа кожного місяця |

| Зняття та перекази кредитних коштів | 4% (мін. 20 грн) від суми операції за кредитні кошти |

Сума кредиту, грн

Розрахунок кредиту на:60 міс.

Базова процентна ставка в міс.

Загальні витрати по кредиту:

Загальна вартість кредиту:

Доля коштів, що видаються в касах та банкоматах Банку 48%

Реальна річна процентна ставка:

*Важливо! Дані розрахунки орієнтовні. Точні розрахунки надаються при оформленні кредиту за умовами обраного продукту і підписанні договору.

Приклад розрахунку вартості

- Ліміт 1 000 000 грн на термін 60 місяців з річною ставкою 38,4%

- Загальні витрати за кредитом складають 1 168 806,90 грн

- Орієнтовна загальна вартість кредиту для клієнта за весь строк користування кредитом (сума кредиту та загальні витрати за кредитом) – 2 168 806,90 грн

Враховуючи неможливість визначити модель поведінки клієнта по використанню та поверненню коштів відновлювальної кредитної лінії. Загальна вартість кредиту та річна процентна ставка та інші обов’язкові платежі за додаткові та супутні послуги Банку розраховані з наступним припущенням:

- ліміт кредиту було використано одноразово в день його встановлення та заборгованість не повернуто протягом пільгового періоду і погашається щомісячно в розмірі обов’язкового мінімального платежу впродовж 60 місяців;

- розмір останнього платежу може відрізнятися від платежу, зазначеного в цьому пункті, і дорівнюватиме сумі фактичної заборгованості за кредитом та процентами, комісіями, що залишилася після сплати Клієнтом всіх попередніх платежів;

- розмір комісій за отримання готівки визначений на дату розрахунку. Розмір комісій може змінюватися в разі внесення змін в Тарифи Банку в порядку, визначеному в Договорі;

- Банк обчислює реальну річну процентну ставку, базуючись на припущенні, що Договір залишається дійсним протягом строку дії, передбаченого умовами Договору, та що Банк і клієнт виконають свої обов’язки на умовах та у строки, визначені в Договорі.

Як клієнт надає свою згоду щодо умов надання банківських послуг?

Приєднання клієнта до публічної пропозиції (оферти) передбачає надання його згоди на зазначені умови надання банківських послуг.

Чи може клієнт відмовитися від отримання рекламних матеріалів?

Клієнт може відмовитись від отримання рекламних матеріалів засобами дистанційних каналів обслуговування.

Чи може Банк вносити зміни в укладені Договори?

Банк не має права вносити зміни до укладених з клієнтами договорів в односторонньому порядку, якщо інше не встановлено договором або законом.

Чи може банк вимагати від клієнта придбання продуктів, які не входять в пакет банківських послуг?

Банку забороняється вимагати від клієнта придбання будь-яких товарів чи послуг від банку або спорідненої чи пов'язаної з ним особи як обов'язкову умову надання цих послуг.

Чи має право клієнт відмовитись від договору про споживчий кредит?

Споживач має право відмовитися від договору про споживчий кредит протягом 14 календарних днів у порядку та на умовах, визначених Законом України «Про споживче кредитування».

Чи наявні кредитні посередники або треті особи при розрахунку платежів за кредитом?

Наявність кредитних посередників або третіх осіб при розрахунках розміру платежів та бази його розрахунків за кредитним лімітом – відсутні.

Яка відповідальність клієнта за порушення своїх зобов'язань?

1. Клієнт несе наступну відповідальність за порушення своїх зобов'язань з Договором - згідно з умовами такого Договору та законодавства України.

2. За порушення умов Кредитного договору Клієнт на вимогу Банку зобов’язаний сплатити в термін/строк, визначений у вимозі:

- у випадку прострочення виконання будь-якого грошового зобов’язання – суму боргу з урахуванням індексу інфляції за весь час прострочення;

- за несвоєчасну сплату нарахованих процентів за користування Кредитом – пеню за кожен день прострочення в розмірі подвійної облікової ставки Національного банку України, що діяла у період такого прострочення, від суми простроченої заборгованості за процентами, але не більше 15% від суми простроченої заборгованості за процентами, якщо інше не передбачено умовами Кредитного договору;

- за інші порушення умов Кредитного договору - штрафні санкції, визначені Кредитним договором.

3. Вимога Банку щодо сплати вищезазначених платежів направляється Клієнту відповідно до п. 2.7 Універсального Договору банківського обслуговування фізичних осіб.

4. Сплата пені та штрафу не звільняє Клієнта від виконання інших зобов’язань, передбачених Кредитним договором.

2. За порушення умов Кредитного договору Клієнт на вимогу Банку зобов’язаний сплатити в термін/строк, визначений у вимозі:

- у випадку прострочення виконання будь-якого грошового зобов’язання – суму боргу з урахуванням індексу інфляції за весь час прострочення;

- за несвоєчасну сплату нарахованих процентів за користування Кредитом – пеню за кожен день прострочення в розмірі подвійної облікової ставки Національного банку України, що діяла у період такого прострочення, від суми простроченої заборгованості за процентами, але не більше 15% від суми простроченої заборгованості за процентами, якщо інше не передбачено умовами Кредитного договору;

- за інші порушення умов Кредитного договору - штрафні санкції, визначені Кредитним договором.

3. Вимога Банку щодо сплати вищезазначених платежів направляється Клієнту відповідно до п. 2.7 Універсального Договору банківського обслуговування фізичних осіб.

4. Сплата пені та штрафу не звільняє Клієнта від виконання інших зобов’язань, передбачених Кредитним договором.

Який строк кредитування?

Строк кредиту – 60 місяців. При цьому строк користування кредитом продовжується на кожні наступні 60 місяців, якщо щонайменше як за 30 календарних днів до дати повернення кредиту Банк не повідомить Клієнта про припинення кредитування.

Який порядок дій Банку у разі невиконання зобов’язань клієнтом?

1. З моменту виникнення простроченої заборгованості – інформування боржників про наслідки несплати та можливі варіанти врегулювання, взаємодія з боржником щодо погашення простроченої заборгованості;

2. Залучення колекторських агентств для роботи з боржниками

3. Претензійно-позовне провадження.

2. Залучення колекторських агентств для роботи з боржниками

3. Претензійно-позовне провадження.

Як отримати картку?

Оформлюйте кредитну картку GOLD у найближчому відділенні або залишайте заявку на сайті.

Які операції враховуються в пільговому періоді?

У пільговому періоді враховуються всі витратні операції з картки – зняття готівки, оплата карткою в магазинах і безготівкові перекази.

На який кредитний ліміт я можу розраховувати?

Розмір кредитного ліміту на картці визначається банком. При наданні паспорту та ІПН, Ви можете розраховувати на суму до 1 000 000 грн.

Яка періодичність погашення мінімального щомісячного обов'язкового платежу?

Перший платіж - з 06 числа місяця, наступного за місяцем, в якому був використаний кредит, по 05 число місяця, що йде через один місяць після місяця, в якому був використаний кредит, другий та кожний наступний платіж - щомісячно до 05 числа кожного місяця.

Чи можуть мені переказати на кредитну картку гроші з-за кордону?

Кредитні картки оформлюються тільки в гривнях, тому поповнити їх можна тільки через український банк. Для отримання переказу з інших країн рекомендуємо Вам оформити будь-яку особисту картку з рахунком у валюті переказу. Проте Ви можете отримати переказ із PayPal, але операція зарахування надійде в українській гривні.

Де можливо поповнити картку?

- через ПТКС/ТСО, iPay, EasyPay (із нарахуванням комісії згідно з тарифами власника термінала);

- через ПТКС АТ КБ «ПриватБанк» згідно тарифів власника термінала;

- за допомогою онлайн-сервісу переказів із картки будь-якого іншого банку України на картку Банку Кредит Дніпро (із нарахуванням комісії згідно з тарифами іншого банку);

- через каси у відділеннях Банку Кредит Дніпро (без комісії);

- через каси інших банків (із нарахуванням комісії згідно з тарифами іншого банку);

- переказом із рахунку в іншому банку України (із нарахуванням комісії згідно з тарифами іншого банку).

-

Тарифи Банку з обслуговування кредитної картки з пільговим періодом Кредитна картка Gold діють з 10.12.2025

- Тарифи Банку з обслуговування кредитної картки з пільговим періодом "Кредитна картка Gold"

- Інформація про істотні характеристики послуги з надання споживчого кредиту GOLD

- Договір про встановлення кредитного ліміту

- Правила безпечного використання платіжних карток

- Універсальний договір банківського обслуговування клієнтів-фізичних осіб

- Заява-згода на укладення УДБО (для мобільного додатку)

- Заява-згода на укладення УДБО (для оформлення на відділенні)

- Заява про відкриття поточного рахунку

- Заява про зміну, встановлення банківських послуг, слово-пароль, ОНТ

- Встановлення і зняття лімітів по карті

- Договір банківського рахунку та надання додаткових послуг

- Поради щодо безпечного користування ПЗ

- Ліміти за видатковими операціями

- Порядок та процедура захисту персонанальних даних суб'єктів персональних даних

- Тарифи Банку з обслуговування кредитної картки з пільговим періодом "Кредитна картка Gold"