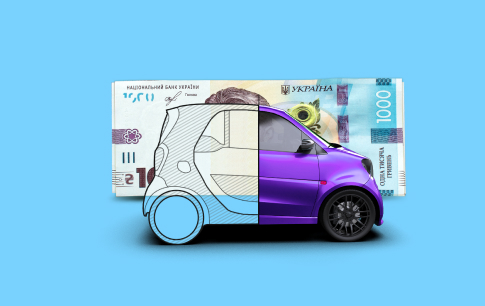

Credits

- Credit up to UAH 500,000

- Term from 12 to 60 months

- Minimum documents

- available loan amount up to UAH 500,000

- term from 12 to 60 months

- no insurance and one-time commission

- available loan amount up to UAH 100,000

- term from 3 to 36 months

- monthly commission from 1.5% to 2.5%

- Credit up to UAH 200,000

- Term up to 24 months

- Minimum documents

- loan up to UAH 300,000

- term from 12 to 60 months

- for your needs

Choose your loan

A loan is a popular financial service, which provides for the lender to provide a certain amount of money to the borrower at interest. You can apply for a loan online at our bank. The possibility of taking out a loan allows consumers, in the absence of a sufficient amount of their own funds, to receive the necessary sum for the purchase of necessary things on a temporary basis. The borrower can take out a bank loan, having specified the exact purposes for which it is needed. More often, consumer loans are taken as financial assistance for the purchase of household appliances, building materials, as well as for cars, for obtaining an education or carrying out repairs.

A bank loan allows you to buy almost any desired product or service at the moment and at the current price, giving you the opportunity not to put off life for tomorrow. Our bank offers to borrow money for any purpose on favorable terms. The loan is issued in the national currency - hryvnias, because according to the legislation currency lending is not carried out in Ukraine.

Operating on the financial market of Ukraine since 1993, our bank is characterized by reliable and stable work. We provide our clients with attractive credit terms, offering different types of hryvnia loans, the opportunity to get a loan for different terms, as well as speedy processing of the transaction.

Using our services, you can profitably issue:

- cash loan - available amount up to 500 thousand UAH;

A cash loan is issued for any purpose for 12, 24, 36, 48 or 60 months. Credit cards provide different credit terms, including a large grace period of 67 days with a low interest rate of 0.01%.

Advantages of our credit offers:

- Simplicity of registration - You can fill out an application for loans up to UAH 200,000 online, and you can find out the calculation and the previous decision about the possibility of receiving funds by phone.

- The possibility of early repayment does not include commissions and fines, and loan payments can be made through the bank's cash desk and terminals, with the help of Internet banking or by transfer from any other payment cards.

- Participation in bonus programs — paying with our premium card, you accumulate points that you can spend on hotel stays, airline tickets, restaurant bills, and car rentals.

Confronted with the question of where to get money for large purchases or a small amount for salary, more and more borrowers decide to get a loan online in Ukraine, organized a loan without visiting a bank branch. The online loan service allows you to apply for a loan directly on the bank's website, specifying the minimum data.

In addition to saving time, a loan via the Internet has such advantages as:

- availability;

- simplicity of design;

- convenience;

- transparency;

- confidentiality.

To take a loan online from a bank, you don't need to adapt to the financial institution's work schedule. It is quite realistic to issue such a loan around the clock, and even from a mobile phone via the Internet. Using the loan calculator available on the site, you can calculate the monthly payment, which will need to be made depending on the amount and terms of the loan. Having adjusted the loan size and repayment term, the borrower will be able to independently choose the optimal loan option for himself. With online registration, the loan can be repaid with almost any payment instrument.

To apply for a loan online in our bank up to 200 thousand. UAH, a minimum of time, documents and procedures will be required.

To obtain loan funds, all you need is:

- fill out an online application - it is available on the bank's website; basic information about the borrower must be specified in the online application;

- receive a preliminary decision confirming the readiness of the bank to issue a loan;

- provide basic documents;

- conclude a standard contract in accordance with the selected credit plan.

A standard online loan application includes the borrower's name, city of residence, identification number and phone number, as well as information about his age and employment. In addition, the desired amount and term of the loan are indicated.

Any client of the bank aged 21-70 can get a loan without proof of income (for a loan of up to UAH 200,000), as well as without checks, without guarantors and collateral.

The following documents must be submitted for registration*:

- passport of a citizen of Ukraine;

- identification number of the taxpayer;

- certificate of income - for loans of UAH 200,000 or more

* The bank reserves the right to request additional documents that are not listed.

A decision on granting a loan can be obtained over the phone. The monthly loan payment is inversely related to the loan term. Detailed information about the range and rates of loans, available repayment channels and forms of standard contracts are presented on the pages of each service in pdf files.