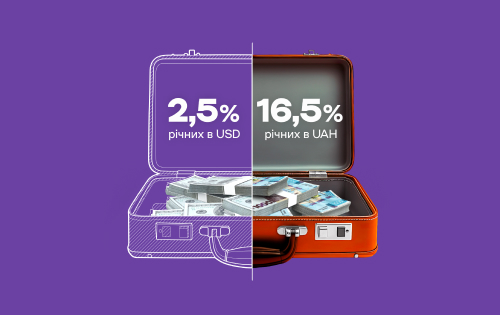

Deposit "Reliable (currency exchange)"

Buy currency

placed on deposit

- Buy the dollar or euro at a best rate

- Place a deposit

- Use the currency at the end of the deposit term

Basic terms

equivalent at the Bank exchange rate per month 1

100 dollars, 100 euros

0.1% to 1.75% per annum in US dollars

0.01% per annum in EUR

US dollars

and euros

93, 184, 367 days

interest payment monthly and at the end of the term

Calculate your profit

Under a period of 3 months. It implies the placement of a deposit for 93 days.

iThe accrued interest on the deposit is subject to taxation in accordance with the Tax Code of Ukraine.

* Personal income tax 18% and military levy 5%

Three reasons to buy US dollars or euros with placement on deposit:

-

First:

the exchange rate for non-cash purchase of currency with subsequent placement in a deposit is always better than the purchase of cash currency at the bank counter;

Secondly:the bank charges you interest on the purchased currency and placed on deposit;

Thirdly:the currency is safe and after the deposit expires, you receive the invested funds in the currency of the deposit, i.e. in US dollars or euros. It is very convenient for storing your savings.

Basic conditions

| Deposit currency | US dollar | Euro |

|---|---|---|

| Rate, per annum | from 0.1% to 1.75% | 0.01% |

| Term of deposit | 93, 184, 367 days | |

| Minimum amount | 100 USD | 100 EUR |

| Maximum amount | up to UAH 200,000 equivalent per month 1 | |

| Attachment | Not allowed | |

| Early breakup | Impossible | |

| Payment of interest | monthly and at the end of the term | |

Leave an application for a deposit, the manager will call you and help you make a deposit remotely or offer a convenient time at the Bank branch of your choice.

We automatically withhold income tax on your accruals:

• tax rate - 18%;

• military tax - 5%

Note that the principal amount of the deposit is not taxed.

Deposit return guarantee

Credit Dnipro Bank is a member of the Deposit Guarantee Fund.

This means that during martial law and three months after it ends, your deposit is protected by the state in full without limiting the amount. That is, the storage of savings in the bank is twice as reliable - you are sure of the return of your deposit and interest under any conditions.

Three months after the end of martial law (what we are all waiting for!) The guaranteed amount will be 600 thousand hryvnia.

More on DGF