Deposit Reliable

Deposit Reliable

Recharge your finances

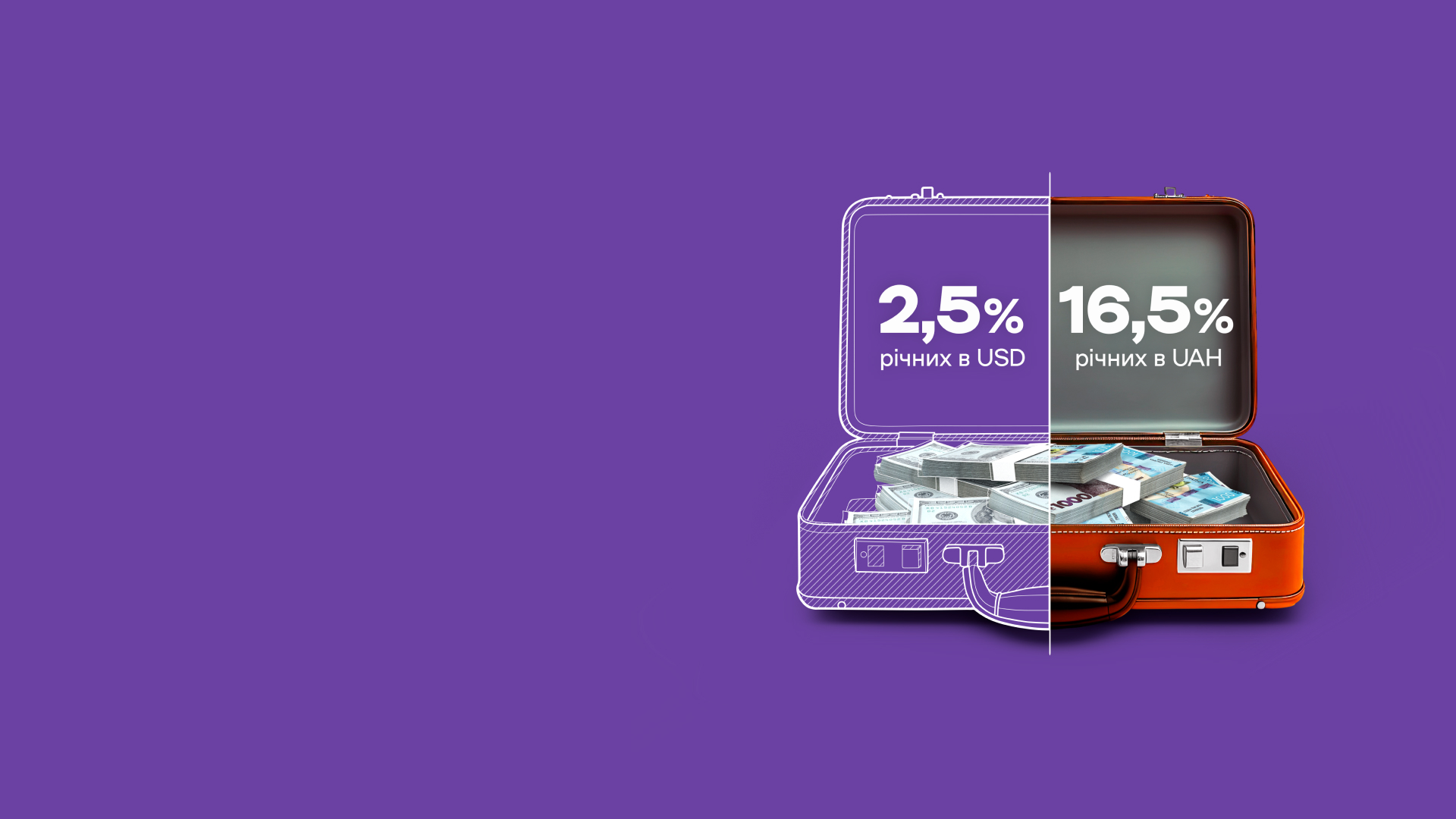

with a rate of up to 16.5% per annum in hryvnias

with a rate of up to 2.5% per annum in US dollars

Basic terms

from 7,0% up to 2,5% per annum

Hryvnia, Dollar, Euro

from 1 to 26 months

500 UAH1, 100 dol. or eur

not set

at the end of the term or monthly

Calculate your profit

Under the term of 1 month. refers to placing a deposit for 30 days, 3 months. - 93 days, 6 months. - 184 days, 12 months. - 367 days, 14 months. - 420 days, 20 months. - 600 days, 26 months. - 780 days respectively.

i* Personal income tax 18% and military levy 5%.

Basic terms

| Currency of the deposit | Hryvnia | USD | Euro |

| Rate, per annum | from 7,0% up to 16,5% | от 0.1% до 2,5% | 0,01% |

| Deposit term | 30, 93, 184, 367, 420, 600 and 780 days | 30, 93, 184, 367, 420, 600 and 780 days | 93, 184, 367, 420, 600 and 780 days |

| Minimum amount | at the branch - 25,000 UAH, 1000 USD and EUR through FreeBank - 500 UAH, 100 USD and EUR |

||

| Maximum amount | not limited | ||

| Early termination | not provided | ||

| Interest payment | at the end of the term or monthly | ||

Leave a request for a deposit, a manager will call you and help you make a deposit remotely or offer a convenient time in the Bank branch of your choice.

Replenishment is available for deposits placed for a period of three months or more and is active within the first 30 days of the deposit. You can top up both through the FreeBank application and through the cash desk of bank branches.

You can open a deposit independently without visiting a branch in the FreeBank application. Log in to the application and go to the Deposits section: click "Open a deposit" and choose the desired deposit conditions.

- Transfer from any account or card of JSC "Bank Credit Dnipro" without commission

- Transfer by IBAN account number from any other bank

- Transfer from the card of another bank to the card GREEN of JSC "Bank Credit Dnipro"

- Cash at any self-service terminal

Choose the interest payment yourself: monthly, or at the end of the term - as it suits you.

We automatically withhold income tax from your payments:

• tax rate – 18%;

• military levy - 5%.

Please note that the principal amount of the deposit is not taxable.

On the last day of the term of the current deposit, we will automatically extend it for the same term at the rate that will be in effect in the bank for this deposit at the time of extension.

The bank may refuse to automatically extend the term of attracting the deposit in the event that on the expiry date of a deposit The conditions for attracting bank deposits do not provide for the appropriate type of deposit or there is no possibility of automatic extension of the term of attracting a deposit under the same conditions.

Deposit return guarantee

JSC "Bank Credit Dnipro" is a member of the Deposit Guarantee Fund.

This means that during martial law and three months after it ends your deposit is protected by the state in full without limiting the amount. That is, the storage of savings in the bank is twice as reliable - you are sure of the return of your deposit and interest under any conditions.

Three months after the end of martial law (what we are all waiting for!) The guaranteed amount will be 600 thousand hryvnia.

More on DGF