Обирайте вашу картку

- 0 грн за

випуск карти - кредитний ліміт

до 1 млн грн

- пільговий період до 67 днів,

ставка 0,01% річних

- Безкоштовне

зарахування будь-яких надходжень

- Безкоштовне p2p

до 50 000 грн - Безкоштовне зняття

- Безкоштовне

зарахування будь-яких надходжень

- Безкоштовне p2p

до 150 000 грн - Безкоштовне зняття

- Безкоштовне

зарахування будь-яких надходжень

- Безкоштовне p2p

до 350 000 грн - Безкоштовне зняття

- Виплата від держави в

рамках програми єПідтримка

- Безкоштовне оформлення,

Apple та Google Pay

Приєднання клієнта до публічної пропозиції (оферти) передбачає надання його згоди на зазначені умови надання банківських послуг.

Клієнт може відмовитись від отримання рекламних матеріалів засобами дистанційних каналів.

Банк не має права вносити зміни до укладених з клієнтами договорів в односторонньому порядку, якщо інше не встановлено договором або законом.

Банку забороняється вимагати від клієнта придбання будь-яких товарів чи послуг від банку або спорідненої чи пов'язаної з ним особи як обов'язкову умову надання цих послуг .

Можливі наслідки для клієнта в разі користування банківською послугою або невиконання ним обов'язків згідно з договором посилання

Серед основних переваг, які забезпечує власнику оформлення кредитної картки, слід назвати надані нею можливості:

- цілодобовий доступ до грошей - володар кредитки може в терміновому порядку і без особистого звернення до банку отримати необхідну кредитну суму в рахунок майбутнього доходу;

- свободу в розподілі грошей - власник банківської кредитної картки може використовувати позикові засоби, що не звітуючи перед банком про те, на що він їх витрачає, в той час як цільове використання класичного кредиту знаходиться під контролем кредитора;

- можливість регулярно поновлювати кредитну лінію - після погашення кредиту в строк клієнт знову може за замовчуванням в повному обсязі використовувати кредитні кошти, не займаючись оформленням нового кредиту.

Багато кредитних банківсьих карток мають так званий пільговий період, протягом якого клієнтові надаються найбільш вигідні умови використання позикових грошей. Крім того, оплата товарів і послуг кредиткою часто приносить її власнику додаткові бонуси: знижки, подарунки і т.д.

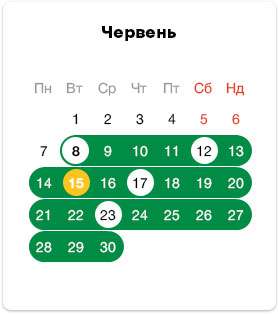

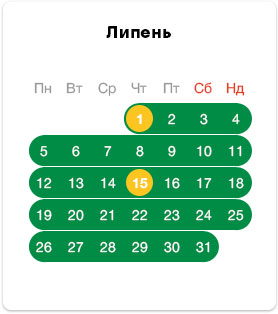

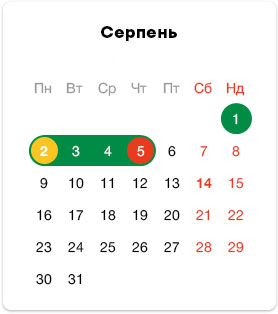

Дати покупок.

Дати покупок.

Тривалість пільгового періоду - період, під час якого не нараховуються відсотки за користування кредитними коштами.

Тривалість пільгового періоду - період, під час якого не нараховуються відсотки за користування кредитними коштами.

Дата заробітної плати/авансу - імовірне/планове отримання зарплатних або авансових виплат.

Дата заробітної плати/авансу - імовірне/планове отримання зарплатних або авансових виплат.

Платіжна дата - день, до якого потрібно повернути суму кредиту станом на останній день позаминулого місяця, щоб користування кредитом було без переплат.

Платіжна дата - день, до якого потрібно повернути суму кредиту станом на останній день позаминулого місяця, щоб користування кредитом було без переплат.